TL;DR:

Creator-driven GMV increased 99% per day during October sales events. Across three major retailers, creator-driven revenue delivered nearly double the daily revenue during deal periods compared to baseline weeks.

Creator commission surged 142% over deal periods in October. This proves that creator audiences don't just click more during high-intent moments, but they convert better and buy bigger carts, making performance-based compensation the smartest Q4 investment.

Brands need to act ASAP to capture Black Friday performance. Lock creator partnerships now before premium talent books up, shift top performers to hybrid commission-based and flat fee models, and brief creators on three-phase campaigns (pre-sale, sale, post-sale) to sustain the performance beyond sales periods.

Table of Contents

October 2025 became retail's unofficial Q4 testing ground with major sales events going on across top retailers. This pre-Black Friday sales moment became a natural experiment in creator marketing performance during high-intent shopping moments, giving marketers a peek into what they can expect going into the holiday season.

Across Later's network during these October sales events, we tracked aggregate performance from our creator affiliate network, Mavely, analyzing daily GMV, clicks, and orders from anonymized retailers. Additionally, we surveyed 403 creators and 222 brands to understand more about their holiday marketing strategies and mindsets going into this holiday season.

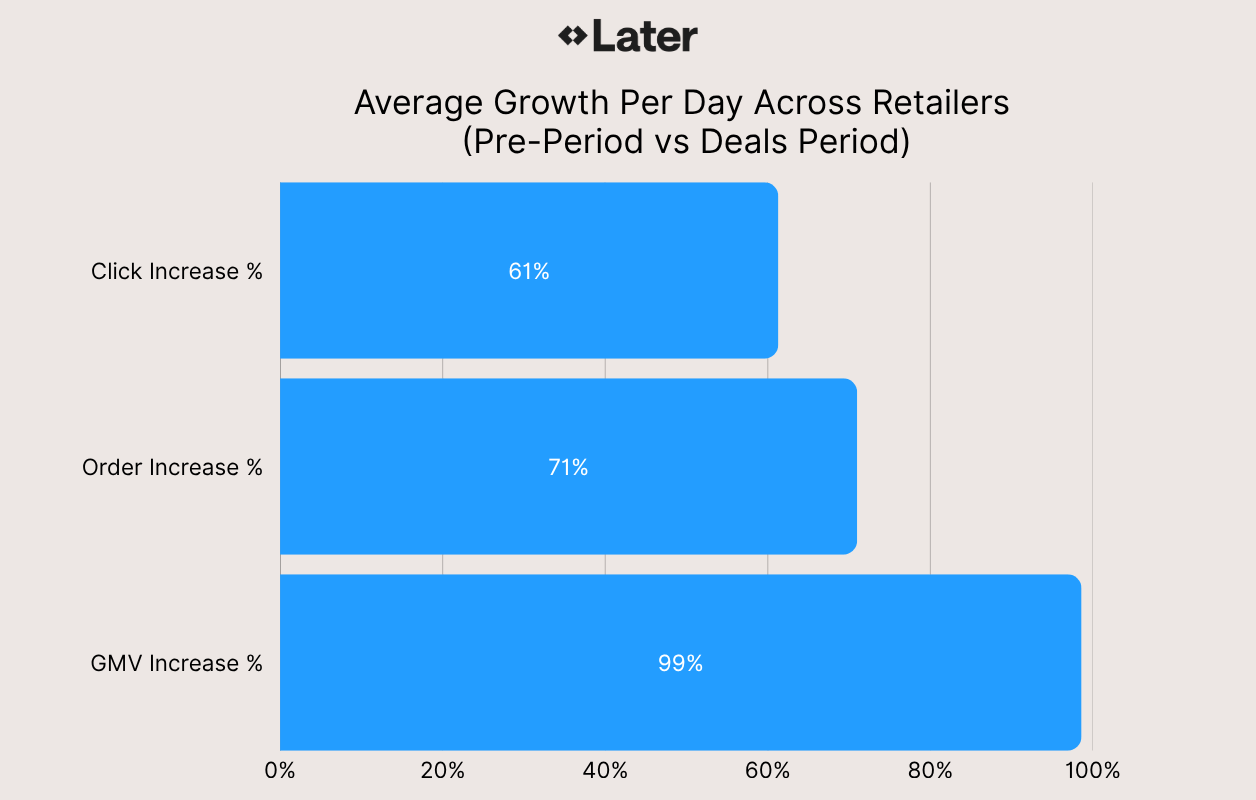

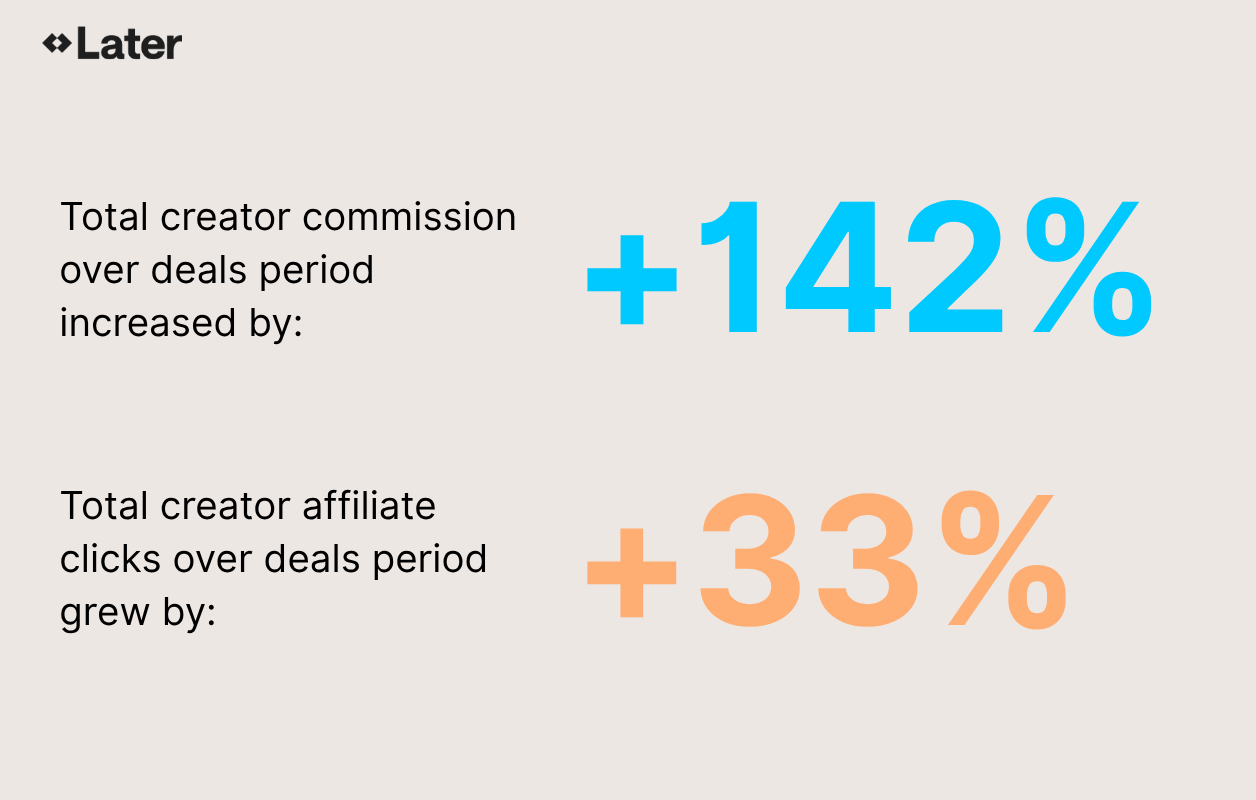

Overall, creator-driven GMV increased 99% per day, per retailer during the October sale periods compared to baseline weeks. Total creator commission increased 142% during deal periods compared to baseline—both of these findings signaling the vitality of incorporating creators into your upcoming holiday campaigns.

The performance story behind October's numbers

When you look at aggregate data, the 99% daily GMV increase tells a clear story about creator effectiveness during high-intent shopping moments. But it’s important to also look at the duration and timing of sales events as well.

One retailer’s 177% daily GMV increase came from an 8-day deal period, while another retailer’s 141% spike was compressed into two days of flash-sale urgency. Longer campaign durations naturally lead to more commission for creators and more GMV earned for brands. Creators can post consistently throughout the week instead of a short 1-2 day window, allowing their audience more time to work their way through the purchase funnel.

Most importantly, creator-driven traffic didn't just increase; it converted at premium rates. Across all retailers, clicks grew 61% per day on average, orders increased 71%, and average GMV increased by 99%. That gap between click growth and GMV growth reveals higher cart values and better conversion rates, suggesting that high-intent audiences arrived ready to buy rather than just browse. This is backed further by the average order value increasing from $65 to $77 during the deal periods, an increase of 16.7%.

Overall, this tells us that the duration and timing of your campaigns matter. Our survey revealed that 41% of creators prefer 1-2 months lead time for partnerships, yet 30% cite "late outreach" as their number one challenge. The data suggests that giving creators longer campaign timelines, not just longer lead time, improves performance sustainability in ways that benefit both creators and brands.

The creator earnings surge

Perhaps the most significant finding from October's sales events is around creator earnings. Total creator commission increased 142% during deal periods compared to baseline, while total creator affiliate clicks grew just 33%. Plus, as mentioned, the average order value increased by 16.7% during the deal periods.

Creators earned dramatically more during October sales per click because their audiences converted better and bought more. When aligned with retail sales events, creator-driven traffic converts at premium rates, and performance-based compensation naturally rewards quality over volume.

This is the performance marketing proof point that justifies creator investment during Q4, especially for brands facing budget scrutiny around holiday spending.

Why category timing matters more than you think

Not all product categories follow the same holiday shopping timeline, and October's data revealed clear patterns about which categories consumers buy early versus which will most likely build momentum closer to Black Friday.

Electronics dominated October, suggesting consumers are making December gift decisions two months early. One retailer saw electronics surge 411% in average daily GMV, while another retailer's electronics subcategories exploded even more, with electronic components & home audio increasing by 3,459%, and cell phones & accessories jumping 817% during its deal period.

While toys increased over deal periods, the percentage growth was much smaller compared to other categories, ranging from 69% to 219% increases in daily GMV depending on the retailer. This suggests toys are still ramping toward peak sales in November and December, which makes sense given the closer proximity to the holiday season.

If you're in electronics or sporting goods, audiences are already in decision mode right now. Focus your creator partnerships on comparison content, gift guides, and deal positioning. If you're in toys or fashion, you're building awareness and consideration now, but should save conversion-focused content for the week leading into Black Friday and Cyber Week.

Three things to do heading into this month

With Black Friday four weeks away, here is what marketing leaders should prioritize now rather than waiting until mid-November.

1. Lock creator partnerships this week

The math on creator availability is straightforward. Our survey showed that 41% of creators prefer 1-2 months lead time for partnerships, and 60% of creators secure 1–5 brand partnerships during the holidays. This means you're already at the threshold of their preferred timeline. As mentioned previously, 30% cite "late outreach" as their number one challenge in working with brands during the holidays, signaling that procrastination creates real friction in partnership quality.

High-performing creators are getting booked for Black Friday at premium rates right now, and brands that wait another week will find themselves competing for second-tier talent or paying significantly more for the creators they actually want. The window for securing your ideal creator roster is closing rapidly.

When you finalize these partnerships, prioritize creators who've driven actual conversions for you in the past rather than focusing solely on reach or engagement metrics. With 1 in 3 creators from our survey saying they have little to no influence in shaping campaigns, brands need to give influencers more creative latitude on format and storytelling—authenticity helps drive the conversion rates.

Be transparent about your full campaign duration when briefing creators. If you're running 5-day Black Friday deals, creators need to know the complete window so they can plan multiple content moments rather than just a single post. Again, more content opportunities mean more money earned for both brands and creators.

2. Consider hybrid performance-based compensation models

The 142% increase in creator commission, paired with 33% growth in clicks, creates a compelling case for rethinking how you structure creator compensation for Black Friday. Performance-based affiliate models align incentives in ways that flat fees simply can't match during high-intent shopping periods.

October proved that affiliate economics work exceptionally well during retail sales events, through structures that reward creators generously when they drive real business outcomes. That said, affiliate structures often work alongside traditional influencer marketing to create a hybrid model: creators make sponsored posts and also drop their affiliate link in their bio to keep cashing in post-campaign.

Consider moving your top-performing creators to a commission-based or hybrid model specifically for Black Friday. You can even go further and set performance tiers with base rates plus commission bonuses for hitting specific GMV thresholds—$10k, $25k, $50k, depending on your category and price points.

Performance-based compensation naturally rewards this quality over volume while giving your finance team the efficiency metrics they need to approve Q4 spending.

3. Plan post-sale content for extended performance

Most brands treat Black Friday and Cyber Monday as separate events that end when the clock strikes midnight on December 1st.

The performance tail is real, and brands that give creators content hooks beyond the official sale dates will sustain elevated GMV measurably longer than those who stop at the finish line.

Schedule post-Cyber Monday content that extends the conversation with "extended sale" offers, "last chance" urgency, and "what I actually bought" authentic testimonials. Plan three distinct content phases from the very beginning of your creator partnerships: pre-sale anticipation and deal previews, conversion-focused content during the sales period, and post-sale extended offers and follow-up content the week after.

Give creators flexibility to create genuine follow-up content rather than prescribing every detail—authenticity matters even more in post-sale content when audiences are evaluating whether they missed out or made smart purchases. Brief creators now on all three phases so they can plan content arcs that build momentum and sustain it, rather than treating Black Friday as a one-day sprint that ends abruptly.

Execute your Black Friday creator strategy with Later

October's sales events make the case clearly: creator marketing during high-intent shopping moments delivers measurable ROI when executed strategically. The 99% daily GMV increase and 142% increase in creator commission demonstrate what's possible when creator partnerships align with retail sales events.

Later can help you scale this performance for Black Friday and beyond. Our creator affiliate network, Mavely, connects brands with thousands of vetted creators ready to drive performance-based results during peak shopping moments. For enterprise brands managing complex creator programs, Later's influencer marketing platform and services team provides the infrastructure to execute multi-phase campaigns, track performance across channels, and optimize in real-time.

Schedule a conversation with our team to learn how leading brands are turning creator partnerships into revenue drivers this holiday season.

Methodology

This analysis combines proprietary performance data from Later's creator network during October 2025, covering major retail sale events from October 4-19, 2025. Data includes aggregated, anonymized metrics, indexed to baseline periods. All cross-retailer comparisons use daily averages (average GMV per day, average orders per day, average clicks per day) to ensure valid comparisons across different deal durations.

Survey research was conducted with 403 creators and 222 brands with more than $5 million in annual revenue running influencer marketing campaigns during October 2025.