TL;DR

While 63% of brands start planning within two months of holidays, 30% of creators cite late outreach as their biggest challenge; the ideal window is 1-2 months ahead to secure top partnerships before the holiday rush.

85% of brands spend over $50K on holiday campaigns, while 70% of creators earn under $5K, creating quality and retention issues that strategic partnership models can solve.

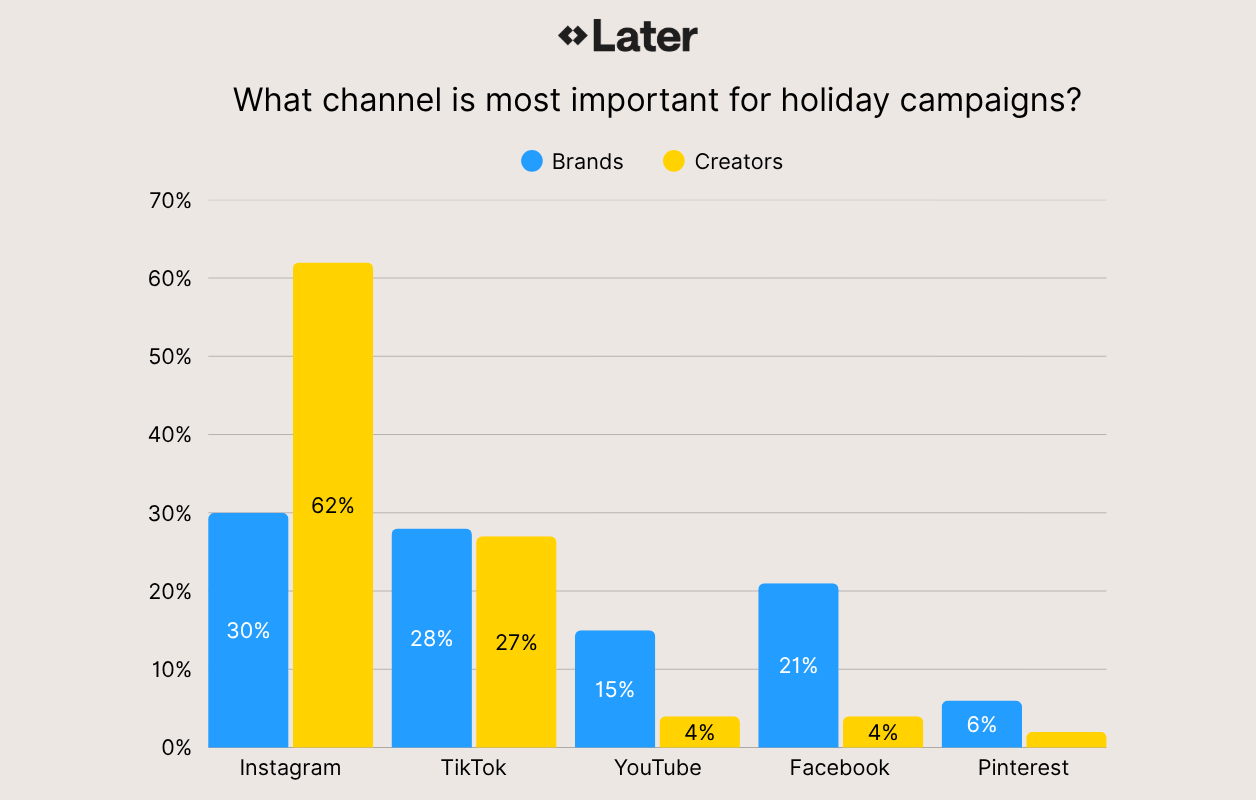

62% of creators prioritize Instagram, but only 30% of brands agree it's their most important channel; diversifying to less saturated platforms like YouTube creates competitive advantages.

82% of creators focus on short-form content, but brands are underleveraging long-form video and static posts, where competition is lower and engagement runs deeper.

Table of Contents

Most enterprise brands have already locked their Black Friday creator strategies. But new research from Later with 222 brands and 403 creators reveals valuable insights that can transform holiday campaign performance so brands understand what creators actually need to deliver their best work.

While brands invest millions into holiday influencer campaigns, the creators driving these results have clear preferences about timing, compensation structures, and collaboration styles. The data reveals specific opportunities around planning windows, budget allocation, and channel selection that can help brands secure top creator partnerships and maximize campaign impact.

The timing trap costing brands their top creators

The research shows that 63% of brands start holiday planning 2 months or less before campaigns launch. Meanwhile, 30% of creators cite late outreach as their biggest holiday challenge, with most creators preferring 1 to 2 months of lead time for holiday campaigns.

When brands wait until six to eight weeks before a holiday to start outreach, they're competing with other brands for that creator's time, with creators' existing commitments, their content calendars, and their bandwidth to produce quality work under tight deadlines.

Additionally, 1 in 3 creators feel like they have little to no influence in shaping campaigns with brands. This stems from late outreach and rushed outcomes. The creators and brands who plan together will see increased ROI and have clearer success metrics.

What brands should do:

Begin Q4 holiday planning in Q2, not Q3. Brands with flexible budgets that can roll into the next year (49% according to the research) have a significant advantage for securing top creator partnerships before the rush.

When developing outreach, create detailed creative briefs that communicate values clearly (53% of creators cite this as critical) while allowing creative freedom for creators within brand guidelines (53% of creators prioritize flexibility).

Set clear success expectations upfront (23% of creators want this) so both parties understand what winning looks like from day one.

Why big brand budgets aren't reaching creators

Eighty-five percent of brands spend over $50K on holiday influencer marketing, yet 70% of creators earn under $5K from holiday partnerships. This gap exists because brands are spreading budgets across multiple creators rather than concentrating spend. While this diversification strategy makes sense for reach and authenticity, it creates an opportunity cost.

The research reveals that insufficient pay is a top challenge for creators (30%), while rising costs rank second for brands (24%). Both sides feel budget pressure, but for different reasons. Brands see increasing creator rates; creators see insufficient compensation for the work required.

Rather than competing solely on rate, brands can win creator partnerships through clear value communication about long-term partnership potential (40% of creators cite this as important), hybrid compensation models combining flat fees with performance bonuses tied to shared metrics, and earlier outreach that allows creators to plan and dedicate appropriate resources.

The brands successfully securing creator partnerships during the competitive holiday season aren't necessarily offering the highest rates, but are establishing better relationships earlier on with creators.

What brands should do:

Rather than pitching a one-off holiday campaign, communicate how every creator partnership could evolve into recurring collaborations, exclusive product access, or co-creation opportunities that extend well beyond December.

Consider hybrid payment models that combine guaranteed base rates with performance bonuses tied to engagement metrics. This structure also naturally aligns incentives around the metrics that matter to both parties.

Prioritize early outreach to creators so they can dedicate their best resources, most creative energy, and prime content calendar spots to your campaign rather than treating it as a last-minute obligation squeezed between other commitments.

The Instagram assumption that's limiting your reach

Sixty-two percent of creators prioritize Instagram as their main channel, yet only 30% of brands agree that Instagram is most important. While creators double down on Instagram, brands have an opportunity to meet creators where they already are while also expanding to less saturated platforms. Instagram remains valuable for its established creator base and high engagement potential, but the brands seeing outsized results are the ones diversifying strategically rather than putting all their budget into a single channel.

TikTok shows the strongest brand-creator alignment, with 28% of brands and 27% of creators ranking it highly. This makes TikTok ideal for campaigns seeking viral, short-form, high-reach outcomes. The research shows that brands are adopting multi-channel approaches to maximize reach, with only 13% identifying content overcrowding as a significant issue.

YouTube and Facebook remain underleveraged by creators (only 4% of creators prioritize each platform), but this is exactly why brands should be actively pursuing YouTube creator partnerships right now. Less competition for creator attention means better availability, more negotiating power, and content that stands out in a less crowded feed. Creators who maintain a strong YouTube presence often have highly engaged audiences and the production quality that longer-form content demands. Plus, YouTube Shorts is starting to rival Instagram and TikTok as Shorts now brings in more revenue than long-form YouTube content.

What brands should do:

Identify creators with an established multi-platform presence rather than those concentrated solely on Instagram.

Provide platform-specific briefs that play to each channel's strengths (quick, trend-driven content for TikTok; longer storytelling for YouTube; community-building for Facebook). One in three brands cite visibility as a key challenge (29%), making underserved platforms where competition is lower particularly valuable for breaking through the noise.

What brands are missing beyond short-form video

Eighty-two percent of creators prioritize short-form video like TikTok, Instagram Reels, and YouTube Shorts. Meanwhile, 59% of creators produce long-form video, but only 41% of brands leverage it. Similarly, 56% of creators create static posts, but only 32% of brands use them strategically.

Long-form video and well-crafted static content offer better opportunities for deeper engagement and conversion, particularly for products that require more explanation or emotional connection. The research shows that brands using unique creative concepts that partner with niche or innovative creators are finding success.

What brands should do:

Diversify content formats by requesting long-form YouTube content for product deep-dives and tutorials, requesting carousel posts that tell stories and educate audiences, and testing blog posts or articles from creators with strong writing voices. Encourage the use of AI for content repurposing.

Test interactive content formats like polls and quizzes (33% of brands cite this as a standout strategy), which provide engagement opportunities that passive short-form video cannot match.

Partner with mid-tier creators who have the capacity and production capabilities to execute across multiple formats.

How Later streamlines holiday creator campaigns

The research uncovered specific gaps between what brands need and what creators can deliver. Later's platform addresses these challenges through integrated tools that support the entire creator partnership lifecycle.

Plan smarter with predictive intelligence

Later EdgeAI uses AI-powered insights to help brands identify the right creators, optimal posting times, and content formats most likely to drive results before you invest. When 30% of creators cite late outreach as their biggest barrier, having data that accelerates confident decision-making creates significant advantages in securing top partnerships early.

Connect with the right creators, faster

Later's creator marketplace bridges the matchmaking gap revealed in the research, where 5% of creators receive zero partnerships while others secure 21+. Our platform connects brands with creators across follower tiers and specialties, with 82% of Later creators falling into the micro and mid-tier categories that 78% of brands prefer.

Execute across channels with consistency

Later supports content planning and publishing across Instagram, TikTok, Facebook, YouTube, and Pinterest, enabling the multi-channel strategies that 35% of brands cite as critical for standing out. Our AI-powered tech stack provides performance insights across all channels, helping brands identify where their specific audience engages most and allocate resources accordingly.

Collaborate with transparency

Later's collaboration features enable the brief development, feedback loops, and shared KPIs that give creators the creative flexibility 53% prioritize while maintaining brand consistency throughout the campaign.

For enterprise brands managing large creator programs, Later's influencer marketing services team provides the infrastructure to execute multi-phase campaigns, track performance across channels, and optimize in real-time.

The reality check for brands this holiday season

The brands winning holiday creator campaigns will be the ones who start earlier, compensate fairly, diversify strategically, and build relationships that extend beyond a single campaign.

This research reveals that success in holiday creator marketing comes from better alignment rather than bigger budgets. The timing gaps, compensation misalignments, channel assumptions, and format limitations all represent opportunities for brands willing to adapt their strategies based on what creators actually need.

Approximately 40% of brands and creators dedicate 10-25% of their budget or income to holiday campaigns. High investment is rare (only 1% go "all in"). This suggests that while holiday campaigns matter, they exist within a broader creator strategy that extends throughout the year.

Ready to build a holiday creator strategy that actually works? Book a demo to see how Later's enterprise solutions can help you start earlier, execute better, and build creator relationships that deliver results beyond the holidays.

Methodology

This research was conducted in two parts: an internal survey with 403 creators from the Later Influence database, and an external survey through the third-party research firm Centiment with 419 brands. Of those brands, 222 qualified based on running both holiday campaigns and influencer marketing campaigns, with $5M+ in annual revenue. All data is self-reported and reflects perceptions and attitudes about holiday creator marketing.